The Paths into the Corporate Boardroom

Paths Into the Corporate Boardroom

[Audio: MP3 10 minutes]

Elizabeth Ghaffari of Champion Boards is interviewed by Frances Anderton, Los Angeles radio producer and host, about the career paths chosen by women on corporate boards of directors at California-based Fortune 1000 firms. Some surprising conclusions! (1/5/2007)

A full transcription of the original, complete interview follows. - 1,729 words.

Q1. How and why did you get interested in women on boards of directors?

I've always admired the women who brought fresh perspectives to solve long-standing problems. Examples in my experience include: Emily Card who won passage of the Equal Credit Act; Stephanie Shirley who founded one of the first and most successful all-female technology consultancies (F International) and the concept of telecommuting; Grace Hopper who didn't just invent the COBOL programming language, but who happened to invent the concept of business rules; and Felice Schwartz who founded Catalyst Inc. and was the first advocate for women in business leadership.

After the turn of this century, when I saw the statistics about how few women were in corporate leadership positions, I asked myself - WHY? And then, NOW, WHAT?

At first, I looked at all of the women's organizations, but was not satisfied that they either understood the scale of the challenge or were capable of addressing the issues facing public for-profit companies.

Q2. What exactly IS "the issue" about women on boards?

There are two sides to the marketplace -- the demand side is the companies and boards that ARE searching for independent, competent directors including women and diverse-thinking talent.

Then there's the supply side of the marketplace -- the women with the appropriate experience, education, and competence that qualifies them to serve at the top level of corporate boardrooms.

We know the demand side has improved a great deal, and for a variety of reasons:

- because Sarbanes-Oxley has put pressure on boards to clean up their act

- because boards are getting pickier about the peers they bring to the table

- because corporations now demand that CEOs limit the number of external boards on which they sit and

- because shareholders, both individual and institutional, are demanding more transparency and performance from their directors.

So, boards are facing a limited resource pool IF they only look at the 50% of the talent that is male.

The question that remains, the issue NOW, is where are the female executives who are preparing themselves to serve effectively as leaders at the board and governance levels at today's corporations?

Q3. You're done research on the women on boards at California-based Fortune 1000 firms for the past 3 years - what does your research tell us?

The women who DO serve on boards today are some of the most talented and competent individuals that public companies could find.

Our research focused on the 114 top women holding 123 board seats at the 101 Fortune 1000 firms based in California.

Q4. What are the paths women followed into the boardroom?

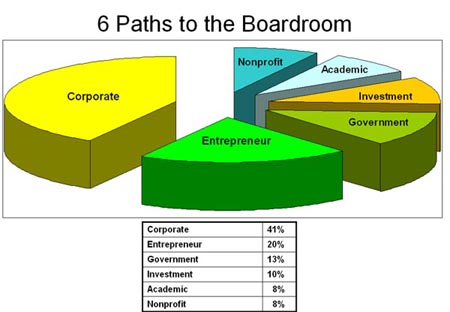

We identified 6 paths they took, based on an analysis of the experience reported in annual proxy statements. The paths are: nonprofit, academic, government, investment, entrepreneurial, and corporate.

Many women took several paths. Some started down one path, and then changed to a different one later on. All of the women showed incredible breadth of service, education, and experience across all the paths, as corporate executives, investors, business entrepreneurs, with in-depth knowledge in technology, finance, and the law.

Q5. Did the women get on board by riding some male mentor coattail?

Women with the longest experience - from the 1970s - were more likely to have been spouses of a corporate founder, but even those women were recognized by their industry as a major corporate asset and a significant contributor to the success of the business.

Examples include Marion O. Sandler who built Golden West Financial into a powerhouse savings institution, with her husband, and recently sold it for billions to Wachovia. Golden West was the ONLY Fortune 500 firm with a majority of females on its board.

Marion Haas, until July of this year, one of four women on the board of Levi Strauss & Company and Doris Fisher, one of three women on the board of Gap Inc. I call these women "Les Grandes Dames" because they were instrumental in establishing their firms with their spouses and also they continued their incredible contributions long afterwards.

Q6. Is it true that most women came to their board roles by way of the nonprofit route?

No. Only 8% of the experience mentioned by the women on boards, in proxy statements, was by way of a nonprofit career path. The nonprofit AND the academic routes to the boardroom are about equal in explaining how the women reached a board role: just over 1 in 12 women.

Q7. What ARE the prominent paths into the boardroom for today's female director?

For the past 10 years, the corporate path has become a much more important route into a director's chair. Corporate experience is cited by almost 42% of the women on California Fortune 1000 boards. The overwhelming majority - 88% of the cited experience - includes a corporate background PLUS either some entrepreneurial experience or some investment experience.

Q8. Is the corporate experience of women in the traditional "soft" positions in human resources? Communications? Marketing?

Again - these are "old wives' tales." The corporate experience is, first, financial (Chief Financial Officers); second, technology (Chief Information Officers or Chief Technology Officers); and third, law (corporate counsel or partner in a law firm).

The reason is that these are the critical areas that corporate boards must address in today's riskier business environment: finance, technology, and law.

Q9. How prevalent is the political path to a board role - the background in government?

A political background also is among the bottom half of the cited experience. Only about 13% and most of the political experience consists of appointment to federal, state, or local department or commissions because the women have some unique expertise that is valued by that position.

Examples include:

- Kathleen Brown (Countrywide Financial) whose investment background qualified her for California State Treasurer.

- Anita K. Jones (SAIC) whose computer security expertise qualified her to serve as Dept. of Defense head of Defense Engineering.

- Linnet Deily (Chevron) has extensive corporate financial experience that she tapped to lead the Geneva 2004 Doha Round of Trade Negotiations as US Trade Representative.

- Charlene Barshevsky (Intel) headed up her law firm's international practice which qualified her as the US Asian trade negotiator.

- Diana Lady Dougan (Qualcomm) drew upon her extensive corporate telecommunications and information technology background when she became State Dept. coordinator for information and telecom trade negotiations.

Q10. Isn't it true that there are more "women in the pipeline" in nonprofit and academic organizations?

Having lots of women in the middle management ranks does not necessarily produce women who are leaders. It takes a special talent, initiative and creativity to rise to the top -- that's also what's required at the governance level as a director on a board. This is a strategic level of responsibility, not a technical level of responsibility.

The same is true of governmental roles and duties. We see almost parity today at the middle management levels of governmental agencies. But, we still see only a few women who rise to the top -- very few women have pursued, successfully, elected leadership roles. That must change.

A good example of a woman rising to leadership levels is Mary S. Metz who started her career as a French teacher by training -- and a very good one at that. She rose through the ranks of both the academic side (to full professorship) and also the administrative side of university life.

She became President of Mills College in Oakland, CA because

she had the leadership skills and competence that were outstanding.

After that, she ran UC Berkeley's Extension program and grew it

into a major distance learning center. Then she headed the S.H.

Cowell Foundation -- a multi-million dollar charitable organization

that provides grants to improve the quality of life of children

and families living in poverty in Northern California. Along the

way, she learned everything there was to know about financial

forensics -- 10 to 15 years ago -- when SHE recognized they were

important parts of corporate financial control, not just when

it became the chic-in-thing. She's been tapped by 4 corporate

boards because they needed her special skills, not just as an

academician, but as an astute strategic financial advisor.

Dr. Alice Bourke Hayes did a similar trifecta -- biology scientist, academic leader, Catholic lay leader who was put in charge of three separate universities and is now on the boards of ConAgra and Jack-in-the-Box.

These women are leaders, not just managers. They know their professional area of expertise AND they know how to apply that knowledge strategically in the other setting -- in the for-profit corporate boardroom.

Q11. The two other paths that you've identified -- entrepreneurship and investment -- what can you tell us about them?

These possibly are the two most important emerging future paths for women to follow into the boardroom.

First, persistent corporate downsizing will compel women to

create alternative career strategies for themselves. Downsizing

and outsourcing fuel the ranks of women-owned businesses as well

as women who realize they must take responsibility for their own

investment strategies and career development.

Second, women represent a large and growing client-base for both the investment and the entrepreneurial sectors. For-profit companies want to tap that client-base, so they need women on their boards to help them understand the risks and rewards of their business strategies.

Q12. Going back to your original questions, we have a better idea of the WHY? Now, what can we expect for the future of women on boards of directors?

I like to highlight a web blog that monitors trends in the area of women in leadership in business. The web site, NewsOnWomen.com, is owned and operated by Alice Krause of New York. She tracks the daily press release announcements of women promoted to top corporate leadership positions, as well as in technology, arts, science, and education. My firm, ChampionBoards.com, has worked with her to track female director announcements since July 2005.

At NewsOnWomen.com, you can see the quality and caliber of female talent being developed and tapped by corporate leaders, in record numbers, today. Women who aspire to leadership roles can read about the experience that's required and learn from today's very best in the business. It's certainly NOT your mother's board anymore.

We have reason to be proud of the accomplishments of these women who have shown that they've earned their promotions on the merits; not through some gender equity entitlement scoring system. These women have gone through the same school of hard work as their male peers. And that is why they now serve at the very top, in leadership positions at our corporate boards of directors.

The opportunities exist for women to serve at the very top, on today's corporate boards. The question remains: are women properly preparing themselves for these truly leadership roles?